If you are planning to build an outdoor barn to store equipment, livestock, or just for a chic rural retreat selecting the best contractor is vital to ensure that the

Learn about the essential requirements for obtaining a housemaid visa in Dubai, including documentation, eligibility, and application process for job seekers.

For busy professionals, staying informed no longer has to be a time-consuming or overwhelming task. Weekly news recaps offer a practical, efficient, and balanced way to stay updated on the most important developments without sacrificing time or mental energy.

عطر “بريتي” من عطورات أجمل الكويت يجمع بين النفحات الزهرية والحمضية والخشبية ليعكس الأنوثة والجاذبية، مع ثبات يدوم طويلاً.

If you’re facing a challenging criminal case, Advocate Narender Singh is ready to guide you through every step of the process. With his expertise and unwavering commitment, you can be confident in securing the best possible outcome for your case.

Explore expert balcony construction tips to create a beautiful outdoor space. Learn about materials, design, and safety that stands the test of time.

When it comes to construction projects, whether residential, commercial, or industrial, a reliable structural engineering consultancy in Melbourne is crucial.

Check out the right things to take into account to build a world of business successfully. Elevate your business with the right funds borrowed from leading direct lenders.

Discover tips on choosing the perfect women’s perfume for every occasion. Learn how to match scents to your mood, weather, and style. Shop for the best perfumes online in Kuwait today!

Discover how business dashboard software simplifies data management and empowers informed decision-making. Learn how it helps businesses achieve goals.

When it comes to maintaining your eye health or seeking advanced treatments for complex eye conditions, choosing the right Eye Hospital near Patiala is crucial

Grow Your Brand with Reliable and Efficient Lead Generation Agency in UAE

Forensic accounting belongs to a category of accounting that combines accountants’ knowledge with detective work to reveal theft, embezzlement and other unlawful deeds. As a precise profession, it is an

When it comes to real estate investments and finding the perfect home, Real Homez stands out as one of the top real estate companies in Noida Sector 63. Known for their commitment to

When considering an investment in Prestige Avon, understanding the price options is crucial. Prices vary based on apartment size and configuration.

Utopia is a fast growing company in Singapore that offers excellent services for cleanroom products, healthcare equipments, cleanroom laundry services with affordable prices and excellent quality.

In the world of UI/UX design, empty states are often seen as a negative aspect of an app or website, representing a "void" when content isn’t available or when users

In the world of UI/UX design, empty states are often seen as a negative aspect of an app or website, representing a "void" when content isn’t available or when users

In this ever-changing and fast-paced business world, maintenance of equipment and facilities has become a very important matter. Nowadays, many businesses face a lot of problems in their operations, so

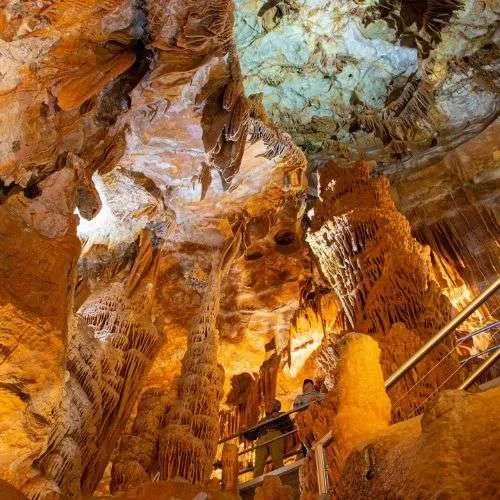

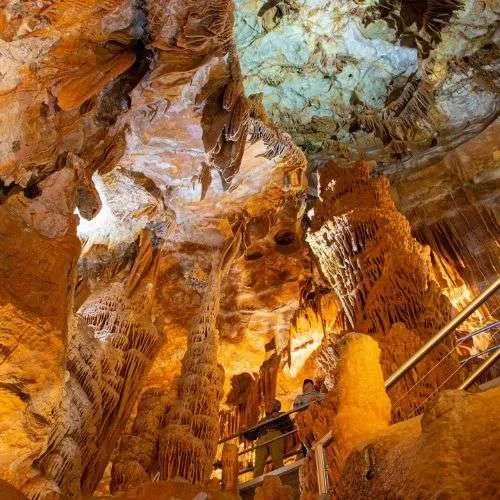

Hunter Valley Wine Tours are far more than a simple tasting experience—they are an enchanting journey through a world where vineyards speak, wines breathe, and the very earth seems to pulse with magic.

Ranks rocket connects website owners with bloggers for free guest posting! Increase brand awareness and backlinks with strategic placements. But remember, quality content is key.