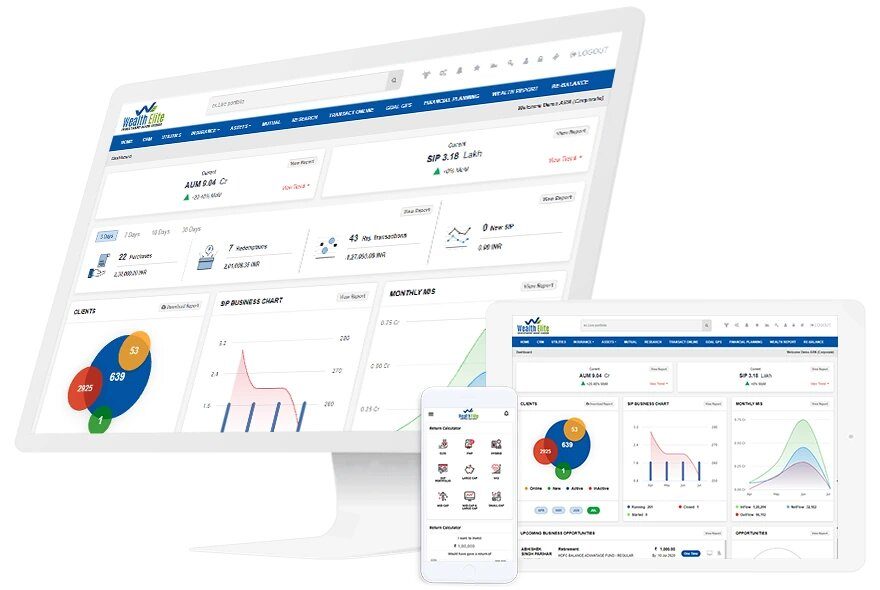

Are you a mutual fund distributor aiming to connect better with clients and grow your business? In the financial world, having the right tools is important. A good mutual fund software for IFA can give you a real advantage. It can work as your partner in building stronger client relationships and reaching your business goals. From managing portfolios and processing transactions to talking with clients and staying compliant with regulations, the right software can transform your business.

A valuable part of good mutual fund software in India is its set of financial calculators. These tools are super helpful for both you and your clients. They offer a clear and simple way to see how investments grow, plan for future goals, and make smart financial choices.

Must-Have Calculators for MFDs

Let’s look at some of the essential calculators your mutual fund software should have:

● SIP Calculator: This popular tool helps clients understand how regular investing works. By entering the amount, how long they’ll invest, and the expected return, clients can see how their money can grow. It’s a great way to encourage regular investing and show the long-term benefits of SIPs.

● Step-Up SIP Calculator: This calculator makes SIP planning even better by letting clients add annual/quarter increases to their investments. This helps them reach their financial goals faster by taking advantage of rising incomes.

● Lumpsum Calculator: For clients with a lump sum to invest, this calculator shows the potential returns based on the amount. So they can understand how long they’ll invest and what returns they could expect. It helps compare different investment options and maximize returns.

● Crorepati Calculator: This motivating calculator helps clients see how to reach a crore (or any amount they want). By setting a target amount and entering the investment details, clients can see the required monthly investment or lump sum needed to achieve their goal.

● STP (Systematic Transfer Plan) Calculator: This calculator helps clients understand how to systematically move funds from one scheme to another. It’s a useful tool for managing risk and getting better returns.

● SWP (Systematic Withdrawal Plan) Calculator: For clients who want regular income from their investments, the SWP calculator shows how much they can withdraw regularly without using up all their money.

● Retirement Planning Calculator: This calculator helps clients plan for a comfortable retirement by estimating their future expenses. This helps to figure out the savings and investment strategy they need. It considers things like inflation and how long they might live.

● Delay Cost SIP Calculator: This calculator shows what happens when you delay investments. It shows clients how much wealth they could lose by putting off their SIPs, highlighting why it’s important to start early.

Goal-Based Planning Calculators:

These calculators help clients plan for specific life goals, such as:

● Vacation Planning Calculator: This helps estimate the cost of a dream vacation and figure out the savings plan needed.

● Income Tax Calculator: Helps estimate tax liabilities and plan for taxes effectively.

● Marriage Planning Calculator: Helps estimate wedding expenses and plan accordingly.

● Education Planning Calculator: This helps estimate future education costs and create a savings plan.

● House Planning Calculator: Helps figure out the down payment and monthly EMI for buying a house.

● Car Planning Calculator: Helps estimate the cost of a car and plan for the purchase.

● EMI Calculator: A general calculator for figuring out EMIs for loans, helping clients understand their repayment responsibilities.

How Do These Calculators Help Mutual Fund Distributors?

These calculators aren’t just for your clients, they’re valuable for you too. They help you:

● Make Things Clear for Clients: Showing investment growth and planning through calculators makes complicated financial ideas easier for clients to understand.

● Build Trust: Offering clear and data-driven insights strengthens your client relationships and makes you a trusted MFD.

● Keep Clients Engaged: Interactive calculators make financial planning more interesting. This also encourages clients to be involved in managing their investments.

● Grow Your Business: Providing excellent service and personalized services attracts new clients and keeps existing ones, leading to business growth.

Conclusion:

In today’s competitive market, having the right tools is key to success. Good software with a great set of financial calculators helps you provide excellent service. Build strong client relationships and achieve your business goals. It’s an investment in your future and your clients’ futures. By using these tools, you can transform your mutual fund distribution business and become a trusted partner in your client’s financial journey. Embrace technology and take your business to the next level.