In the high-stakes world of commercial aviation, the margin for error is razor-thin. Profitability can be elusive, and missteps—whether strategic, operational, or financial—can quickly lead to a downward spiral. Jet Airways, once India’s premier full-service airline, provides a striking example of this dynamic. Its meteoric rise and dramatic fall offer rich insights into the risks and realities of the aviation sector.

This article explores the key lessons from the Jet Airways journey and what today’s airlines, investors, and policymakers can learn from its trajectory. It also examines the broader implications of financial turbulence in aviation, drawing upon the Jet Airways case study.

The Rise: A Brand Built on Premium Service

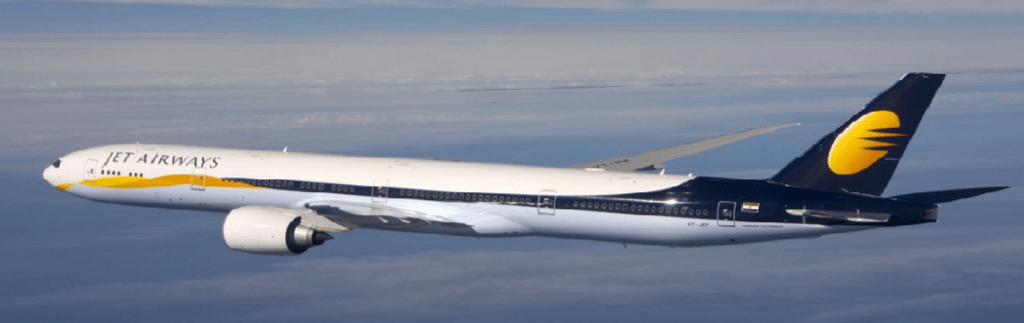

Founded in 1992 by Naresh Goyal, Jet Airways began as an air taxi operator and swiftly grew into India’s largest full-service airline by the mid-2000s. The brand carved a niche with its superior in-flight service, punctuality, and extensive domestic and international network.

For over a decade, Jet Airways was synonymous with quality air travel in India. It expanded aggressively—introducing wide-body aircraft, acquiring Air Sahara (rebranded as JetLite), and entering lucrative international routes. At its peak, the airline operated over 120 aircraft and served more than 60 destinations globally.

But behind the glossy exterior, trouble was brewing.

Lesson 1: Growth Without Sustainable Profitability is a Risky Flight

While Jet Airways expanded quickly, it did so without a firm grip on profitability. The airline industry is capital-intensive, and cost control is paramount. Jet relied heavily on leasing aircraft, incurred significant debt, and operated on thin margins. The acquisition of Air Sahara, although strategic in terms of market share, added to financial stress without contributing meaningful long-term value.

For any airline—or indeed, any business—scaling must be sustainable. Expansion without profitability often leads to a fragile financial foundation, unable to weather unexpected headwinds like rising fuel costs, currency depreciation, or economic slowdowns.

Lesson 2: Market Positioning Requires Constant Reevaluation

Jet Airways attempted to serve both premium and price-sensitive markets. It ran full-service and low-cost operations under separate brands—Jet Airways and JetLite. However, the lack of a clear brand identity confused customers and diluted operational efficiency.

Low-cost carriers (LCCs) like IndiGo and SpiceJet capitalized on the budget segment and operated with leaner models. Jet Airways, burdened with higher operating costs, struggled to compete on fares while offering premium services.

Strategically, it’s essential to focus: are you a premium carrier or a budget airline? Jet’s attempt to straddle both worlds without a robust strategy proved unsustainable.

Lesson 3: Cash Flow is King in Aviation

Cash flow management is not just a financial function; it’s a survival imperative in aviation. Jet Airways consistently operated with negative cash flow and relied on short-term borrowings and vendor credit to stay afloat. Delays in salary payments, lease dues, and fuel payments were early signs of distress.

The airline failed to build a cash reserve, leaving it vulnerable when lenders and suppliers withdrew support. In the final days, operations halted abruptly, staff were grounded, and passengers were left stranded.

The key takeaway? Revenue may be vanity, but cash flow is reality—especially in an industry with high fixed costs and narrow margins.

Lesson 4: Leadership Vision Must Be Adaptive, Not Autocratic

Jet Airways was closely associated with its founder Naresh Goyal, who held a dominant role in strategic decisions. While founder-led vision can be powerful, it can also become a liability when that vision fails to evolve.

Critics argue that Goyal resisted changes in leadership, rejected external advice, and delayed corrective action even as financial troubles mounted. The airline industry had changed, but Jet Airways’ strategic direction did not keep pace.

Modern businesses need leaders who are adaptive, collaborative, and data-driven. Rigid leadership models are especially dangerous in dynamic industries like aviation.

Lesson 5: Transparency Builds Trust—With Investors, Employees, and the Market

As Jet Airways began to spiral, it struggled with communication. Investors were kept in the dark about the extent of financial issues. Employees were unclear about their future. Customers faced frequent delays and cancellations with little information.

This lack of transparency eroded trust—a vital asset during a crisis.

In any industry, but especially aviation, trust is currency. Communicating proactively with stakeholders, sharing realistic timelines, and setting expectations—even in uncertainty—goes a long way in preserving goodwill.

The Decline: A Case Study in Strategic and Financial Mismanagement

Jet Airways’ downfall was not the result of a single misstep but a cascade of failures. Aggressive fleet expansion without cost optimization, mounting debt, weak pricing strategies, and an inability to renegotiate aircraft lease terms were all contributing factors.

By April 2019, the airline suspended all operations. Over 20,000 employees were left in limbo. Lenders refused to offer further financial lifelines without a turnaround plan. The brand that once dominated Indian skies became grounded.

This raises a critical industry question—is Jet Airways closed permanently?

The answer is more complicated than a simple yes or no.

The Attempted Revival: A New Chapter or a False Start?

In 2020, the Jalan-Kalrock consortium won the bid to revive Jet Airways under the Insolvency and Bankruptcy Code (IBC). Plans were made to resume operations with a leaner structure and renewed capital infusion.

However, the revival has faced delays due to regulatory challenges, unresolved debts, and differences with airport authorities and lessors. As of early 2025, while there have been developments and ongoing attempts to relaunch the airline, operations have not resumed at full scale.

The uncertainty around Jet’s comeback remains a topic of industry-wide speculation and interest, making it an evolving jet airways case study on post-bankruptcy aviation recovery.

Lesson 6: A Crisis Plan is Not a Luxury—It’s a Necessity

Jet’s unraveling revealed a stark truth: the airline lacked a viable contingency plan. While it courted investors and sought bailouts, it failed to implement an internal crisis strategy—such as asset reallocation, route optimization, or employee restructuring.

A well-defined crisis response framework helps organizations respond to shocks and manage stakeholder perceptions. For airlines, this means understanding what routes to cut, how to preserve cash, and how to communicate closures or cutbacks in a dignified, structured way.

Lesson 7: Strategic Partnerships Must Add Real Value

Jet Airways had several partnerships over the years, including a significant stake sold to Etihad Airways in 2013. However, the strategic value of this alliance remained limited. Etihad’s support was more financial than operational, and the synergy between the two airlines was not meaningfully leveraged.

Strategic alliances should lead to shared routes, resource optimization, and knowledge exchange. In Jet’s case, the partnership with Etihad did not yield long-term benefits or structural improvements.

This highlights that partnerships should not just be about funding—but about alignment in goals, operations, and value delivery.

What Can Today’s Airlines Learn from Jet Airways?

Jet Airways is a cautionary tale for airline entrepreneurs, policy-makers, and investors. It reveals the critical importance of balancing ambition with prudence. Key lessons include:

- Never compromise on cash flow discipline.

- Stay focused in market positioning.

- Evolve leadership styles as the market changes.

- Communicate clearly and frequently.

- Build strategic alliances that extend beyond capital.

Moreover, for investors and business strategists, the jet airways case study underlines the need for rigorous due diligence and ongoing performance monitoring—not just during acquisition but throughout the investment lifecycle.

Conclusion: Flying High Requires Grounded Strategy

Jet Airways’ fall was not inevitable. With sharper execution, disciplined growth, and agile leadership, it might have weathered the storms. But its collapse has now become a touchstone in Indian aviation history—an example of how even legacy brands can falter without sound financial planning and adaptability.

As aviation continues to evolve—especially with rising competition, green regulations, and post-pandemic behavioral shifts—the stakes are even higher. Airlines must learn from Jet Airways, not just to survive, but to build resilient, profitable, and future-ready businesses.

Whether Jet Airways will ever return to the skies in its former glory remains uncertain. But its legacy—of highs and hard lessons—continues to shape the contours of Indian aviation.