Hiring a Node.js developer for your project can be a strategic decision that propels the development process and helps achieve the desired results efficiently. Node.js has become one of the

A confident smile can leave a lasting impression, making cosmetic dentistry an essential investment for those looking to enhance their appearance. However, achieving the perfect smile requires the expertise of

When it comes to enhancing your property with high-quality brickwork, stone installation, or other masonry services, finding the right company is essential. Choosing trustworthy masonry companies in New Orleans, LA

As Brampton approaches 2025, the city's architectural landscape is undergoing a remarkable transformation. At the forefront of this evolution is Vulcan Hats Construction, a leading construction company in Brampton, renowned

A Fiverr clone with advanced features like secure payment gateways, real-time chat, and customizable service packages can help you create a competitive platform

Joint pain can be debilitating, affecting mobility, flexibility, and overall quality of life. Whether due to aging, arthritis, or intense physical activity, finding an effective solution for pain relief and

It is a significant milestone in anyone's life when he or she gets to drive. Freedom and convenience are synonymous with driving. It is, however, important to select the right

NEBOSH Certificate is ideal for beginners in health and safety, while the NEBOSH Diploma offers advanced knowledge for senior roles in safety management.

Data is the backbone of modern enterprises, and businesses need advanced tools to extract meaningful insights. Microsoft Fabric is a next-generation analytics platform designed to unify data engineering, business intelligence,

To get the best grooming tools and supplies, visit Tack Wholesale. They offer a wide range of horse grooming kits and horse grooming totes, along with other essential horse tack products. Their Winter Sale is ending soon, so don’t miss the chance to grab top-quality grooming tools at great prices!

Discover how acupuncture in Chennai can relieve pain, reduce stress, and restore balance. Learn about its holistic benefits and what to expect during treatment.

Plurance’s kraken clone script enables to launch crypto exchange like kraken with advanced features that outperforms competitors in the market.

Step into the future of content creation, where innovation meets creativity in ways we could have only imagined. Generative AI is revolutionizing the way businesses approach content generation, opening up a world of possibilities and potential. Join us as we explore how this cutting-edge technology is reshaping the landscape of content creation and maximizing business opportunities like never before!

Hosting a memorable event, whether it’s a grand wedding, an intimate house party, or a milestone celebration, requires attention to detail and, most importantly, exceptional food. The art of catering

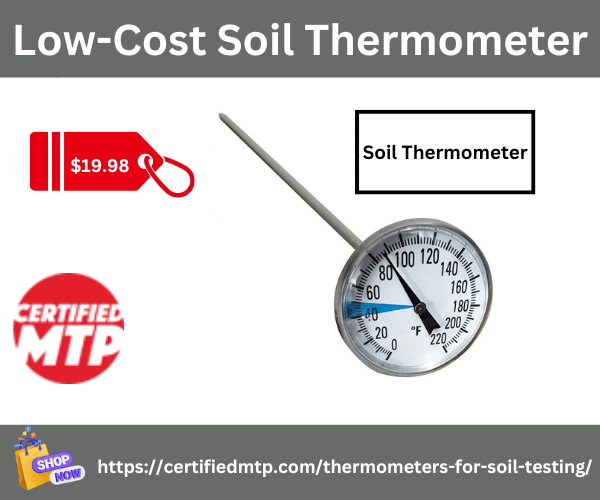

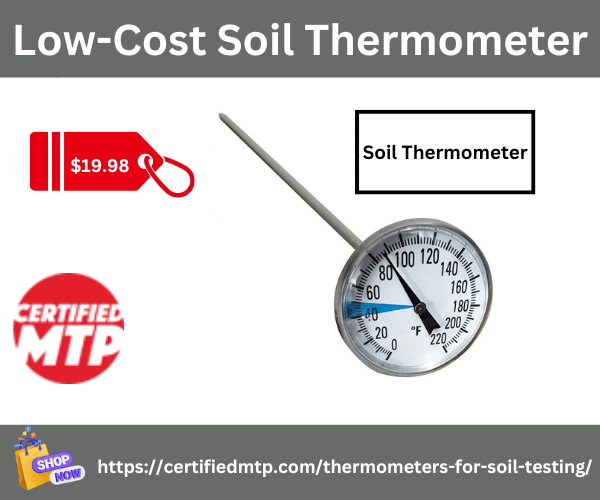

Certified MTP offers a high-quality, budget-friendly soil thermometer. It is easy to use and lasts a long time. Whether you are growing food, doing research, or working in construction, this tool is very helpful.

The Aztec Jaguar Art, often depicted in Aztec art, holds deep cultural and symbolic meaning in Aztec society. To understand the significance of the Aztec Jaguar Art culture, we must first examine the roles it played in the society’s mythology, religion, and daily life.

Essential Clothing Minimalism and Capsule Wardrobes

it’s time for a replacement! We offer high-quality, long-lasting batteries, and our experienced technicians ensure that your laptop is back to full power in no time.

Tablets and iPads have become essential devices for work, entertainment, and communication. However, like any electronic device, they are prone to problems that can impact functionality. Understanding these common issues

Die Bachelorarbeit ist ein bedeutender Meilenstein im Studium – Wochen oder sogar Monate harter Arbeit fließen in die Erstellung. Doch bevor du deine Arbeit abgibst, stellt sich eine entscheidende Frage: Wo kann man die Bachelorarbeit in Mainz professionell binden lassen?

Ranks rocket connects website owners with bloggers for free guest posting! Increase brand awareness and backlinks with strategic placements. But remember, quality content is key.