The millennium started with a bang of digitalisation, and the world has not stopped since then. Healthcare, on the other hand, has always been the top priority of all human beings. The two have collaborated now. Digitalisation and healthcare are together offering better lives and accessibility to all. It did not happen in a snap of fingers but gradually escalated, such that now you can pay your premiums and claim your insurance with that little black mirror in your pocket.

In this piece, let us help you decipher how health insurance in India matches the international level and how you can make the best out of it. An insight into the need for digital transformation and the limitations associated with it.

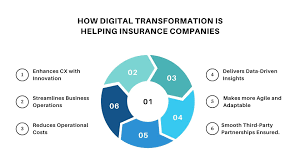

Need for digitalisation in the health insurance industry.

With everything fast-paced and insurance holders still scrambling between the paperwork, the instinct that managing policies should also be a click away, just like everything else. This notion is what inspires the industry to upgrade its management to digital. Furthermore, the internet and mobile apps allow more transparency to the claim settlement process along with premium payments. Policyholders feel more in control and require minimum interaction with the agents.

Evolution of medical insurance in India after digital outburst

From getting instant updates on your premium renewal to learning about the terms and conditions of the insurance policy, it has offered people peace of mind like never before. The section below includes how far has digitalisation impacted healthcare insurance.

Online Policy Purchase and Renewal

Unlike before, now a policyholder can seamlessly check their premium due dates and pay them online without reaching out to the company directly. health insurance plans for family has completely empowered customers with control over their own plans. Not only renewals and premium payments but also purchases can be made online.

Streamlined Claims Processing

Earlier, customers used to go through a multi-step procedure to claim their settlements during reimbursement and discharge from the hospital. Now all can do so from the mobile application. The option of a cashless insurance claim is possible because of the mobile penetration into everybody’s life and internet access.

Personalised Health Plans

Insurance apps and websites have features with the help of which a customer can customise and design their own plans however they like. This could be extremely difficult if not for internet literacy, healthcare, and digital collaboration. Checking a specific plan of a customer could be a tiresome deal for the providers too.

Telemedicine Integration

One call and you have your medicines right at the front door. Who would have imagined it was possible about half a century ago, and now it is as real as it comes? Top health insurance providers, such as Niva Bupa, offer acute care unlimited teleconsultation with doctors. Within a few minutes, you can receive the assistance and aid you need.

Fraud Detection

A new crime is circulating in the country, where people get calls for fake medical emergencies impersonating healthcare providers or insurance companies. With the help of the digitalisation of health insurance in India, it has become easier to track these kinds of fraudulent activities. You will receive warnings from the company. So there you go with the fraud detection!

AI-Powered Customer Support

Gone are the days when you used to call the agents for minor inconveniences. Now you can get advice and correct answers to your queries via their chatbots. Artificial intelligence is everywhere, so why not with the healthcare insurance department? Ask your questions carefreely and hassle-freely.

Related challenges

Every coin has two sides, and so does healthcare digitalisation. As much as the country has evolved since the era of digitalisation, some aspects still remain unsolved. Here is a glimpse at the challenges that are yet to be dealt with.

- Data Privacy and Security- Data breaches are common when the security is not intact. The industry is transforming and upgrading every day and working hard to secure the sensitive health data of all individuals.

- Digital Literacy- Gen Z and millennials are familiar with the concept, but educating the older generations about the use of devices and the internet can become a challenge. They may not be able to keep up with the fast processes and access health insurance in India like the younger ones.

- Infrastructure Limitations- Some remote areas of the country may still have issues with internet and device availability. As soon as these resources are taken care of, the digital infrastructure will completely dominate the health insurance industry.

In Short

A progressive nation demands citizens to be aware of the resources and access them for a better quality of service. The digital revolution of health insurance in India has offered many opportunities for policyholders to save time and money. It also becomes the responsibility of the customers to access them the way it should be and be educated about it.

A leading insurance company, Niva Bupa, offers several digital techniques to its policyholders. This includes Insta Assist, a customer servicing platform for seamless tracking of the claim status, and lets them get coverage details in one click. Try Niva Bupa for an advanced health insurance approach and watch your premiums being paid on time to a company that has an excellent record.