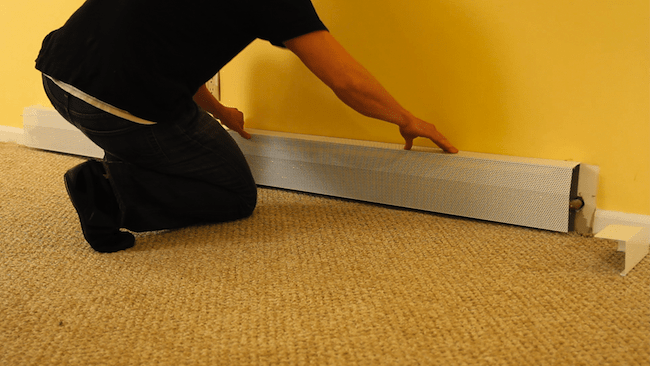

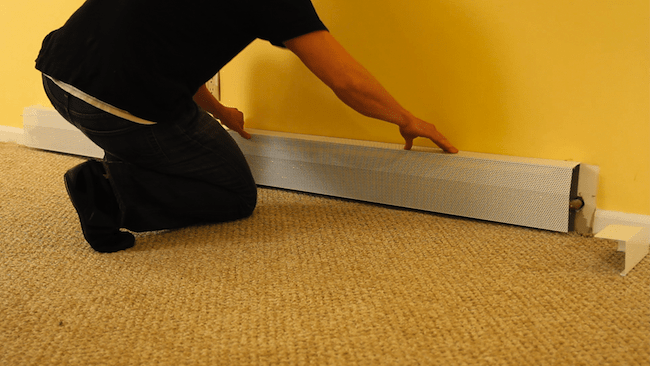

Transforming your home into a haven of comfort and style often begins with the right flooring solutions. In South Florida, where the climate and lifestyle present unique challenges, choosing and

Regular lifeboat service is crucial for ensuring safety at sea. It involves maintenance, inspection, and testing to keep lifeboats ready in emergencies.

Kaufen Sie Hochwertige Favela Clothing Zum Sonderpreis. Erhalten Sie Bis Zu 30 % Rabatt Im Online-Shop. Kostenloser Und Schneller Versand Weltweit.

Discover the most sought-after courses for Indian students in France. Enhance your career and explore global opportunities.

Shop billionaire studios clothing at sale price. Get up to 30% off on billionaire studios brand from online store. Fast shipping worldwide.

UK Short-Term Study Visa: Rules for International Students

Gloucester, with its historic charm, diverse community, and excellent quality of life, is a popular choice for people looking to settle in the UK. For those seeking long-term residency, understanding

Facebook Scraper has revolutionized the way businesses and researchers extract and analyze data from Facebook.

The internet has made it possible to purchase almost anything, including weed. But is buying weed online legal, and how can you do it safely? Here’s what you need to know.

Best Massage Outcall in Bangkok, delivery To Your Home / Hotel / Condo. Similan Thai Massage, The best Massage Outcall in Bangkok, We provide girls massage outcall Bangkok 24/7 by our professionally trained masseuses.

In today’s competitive industrial landscape, maintaining high product quality is essential. Adhesion quality plays a pivotal role in ensuring the durability and reliability of products in various industries, including packaging,

Discover how cigarette pack sizes vary worldwide, from the standard 20-cigarette packs to regional differences and carton quantities.

Embarking on an off-the-beaten-path adventure in Romania promises a wealth of unique travel experiences away from the usual tourist trail.

From Data to Decisions: How Our AI Consulting Agency Can Drive Business Growth

Kanjurmarg’s emergence as a prime location for new residential projects is no coincidence. Its strategic location, excellent connectivity, modern infrastructure, and investment potential make it a compelling choice for homebuyers and investors alike.

SIA training guarantees that the traffic marshal security officer in London upholds industry standards and follows high standards of safety.

Screen printing has long been a popular method for creating custom designs on apparel, posters, and other materials.

The field of dentistry has seen remarkable advancements over the years, and the future looks even more promising. With cutting-edge technology transforming patient care, the days of uncomfortable and time-consuming

English Golden Retrievers are celebrated for their loyal temperament, friendly nature, and elegant appearance. Whether you’re seeking a devoted family companion or a well-bred show dog, All Four Paws offers

Shop the exclusive Eric Emanuel (EE) shorts and Stussy Hoodies collection at the official shop. Limited stock available order yours now.

Ranks rocket connects website owners with bloggers for free guest posting! Increase brand awareness and backlinks with strategic placements. But remember, quality content is key.