The global LTCC and HTCC market size attained a value of USD 1,077.38 million in 2023. The industry is further expected to grow at a CAGR of 4.5% in the forecast period of 2024-2032, reaching a value of USD 1,605.30 million by 2032. This growth reflects the increasing demand for advanced ceramic technologies across various sectors, including automotive, telecommunications, aerospace, and medical applications. In this blog post, we will explore the current state of these markets, examine key trends, and provide insights into their future.

1. Market Overview

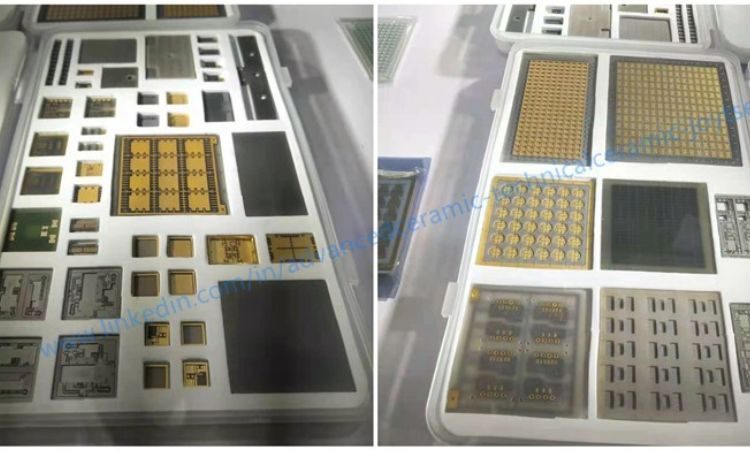

LTCC and HTCC technologies are integral to the development of electronic components due to their superior thermal and mechanical properties. LTCC materials are typically processed at lower temperatures, allowing for the integration of various components, while HTCC materials are designed to withstand higher temperatures, making them suitable for more demanding applications. Both technologies are crucial for miniaturizing electronic devices and improving performance, paving the way for innovations across multiple industries.

2. Market Size and Growth Trends

As of 2023, the global LTCC and HTCC markets have witnessed significant growth, driven by the increasing adoption of these technologies in various applications. The anticipated CAGR of 4.5% from 2024 to 2032 suggests robust future expansion. Factors contributing to this growth include advancements in materials science, rising demand for miniaturized electronic components, and the expanding use of ceramics in high-performance applications.

The automotive sector is a primary driver, as manufacturers increasingly rely on LTCC and HTCC for electronic components in vehicles. Similarly, the telecommunications industry demands high-performance materials for components that can operate reliably in diverse environmental conditions.

3. Analysis by Process Type

3.1 LTCC

LTCC technology is characterized by its ability to integrate multiple layers of circuits and components into a single substrate. This feature is particularly advantageous in the production of RF (Radio Frequency) components, sensors, and filters. Recent advancements in LTCC processes have enhanced their reliability and efficiency, enabling the production of more complex designs.

3.2 HTCC

HTCC technology is distinguished by its ability to withstand high temperatures and harsh environments, making it ideal for aerospace and defence applications. HTCC components are known for their excellent thermal stability and mechanical strength. Recent innovations in HTCC materials have further improved their performance, opening new avenues for application in areas requiring high durability.

4. Analysis by Material Type

4.1 Glass Ceramic Material

Glass ceramic materials are essential in both LTCC and HTCC technologies due to their excellent dielectric properties and thermal stability. These materials can be tailored to specific applications, making them suitable for a wide range of electronic devices. The versatility of glass ceramic materials has led to their increasing adoption, particularly in telecommunications and medical applications.

4.2 Ceramic Material

Traditional ceramic materials also play a vital role in the LTCC and HTCC markets. Their inherent properties, such as high strength and resistance to thermal shock, make them ideal for various applications. With ongoing research and development, new ceramic compositions are being developed to enhance performance and expand their applications in advanced electronic systems.

5. End-Use Applications

5.1 Automotive

The automotive industry is a significant end user of LTCC and HTCC technologies. As vehicles become increasingly reliant on electronic components for functionalities such as navigation, infotainment, and advanced driver-assistance systems (ADAS), the demand for reliable and efficient materials continues to grow. LTCC and HTCC components are crucial for automotive sensors, control units, and communication devices.

5.2 Telecommunication

Telecommunications is another critical sector for LTCC and HTCC applications. With the rise of 5G technology and the need for faster, more reliable communication systems, the demand for advanced ceramic materials has surged. These materials are used in RF filters, antennas, and other components that enhance the performance and efficiency of telecommunications networks.

5.3 Aerospace and Defence

In the aerospace and defence sectors, the performance of materials is paramount. HTCC components, known for their durability and ability to operate in extreme conditions, are used in avionics, missile systems, and various high-stakes applications. The reliability of these materials can directly impact mission success, making them indispensable in these industries.

5.4 Medical

The medical industry increasingly relies on advanced ceramics for various applications, from imaging devices to implants. LTCC technology is particularly useful in developing sensors and diagnostic devices that require high precision and reliability. The ongoing push for miniaturization and improved performance in medical devices ensures a steady demand for these materials.

5.5 Other Industries

Other sectors, including consumer electronics and industrial applications, are also embracing LTCC and HTCC technologies. The versatility and reliability of these materials allow for their integration into a wide array of products, further propelling market growth.

6. Regional Analysis

The LTCC and HTCC markets are experiencing varied growth across different regions. North America and Europe have established themselves as leaders in innovation and application development. However, Asia-Pacific is emerging as a significant player, driven by its booming electronics manufacturing industry. Countries like China, Japan, and South Korea are investing heavily in ceramic technologies, influencing global market dynamics.

7. Market Dynamics

7.1 SWOT Analysis

- Strengths: The unique properties of LTCC and HTCC technologies, including their thermal stability and integration capabilities, position them favorably in the market.

- Weaknesses: High production costs and complex manufacturing processes can pose challenges for wider adoption.

- Opportunities: The increasing demand for miniaturized and efficient electronic components presents significant growth opportunities.

- Threats: Intense competition and rapid technological advancements in alternative materials could impact market share.

8. Competitive Landscape

The competitive landscape of the LTCC and HTCC markets features several key players, including multinational corporations and specialized manufacturers. Companies are focusing on innovation, partnerships, and strategic acquisitions to enhance their market positions. Continuous research and development efforts are crucial as they seek to meet the evolving needs of various industries.

9. Future Outlook

The outlook for the LTCC and HTCC markets remains positive, with significant growth expected over the next decade. Emerging trends, such as the integration of smart technologies and the push for sustainability, will shape the future of these industries. Stakeholders are encouraged to stay abreast of these developments and consider strategic investments to capitalize on the growth opportunities ahead.